How to build Credit as a Newcomer to the UK

Moving abroad usually means starting afresh.

This is especially true for your credit history because as a newcomer, you have no financial footprint in the UK and whatever credit record you have built elsewhere counts for nothing in your new country.

As a credit-based society, having no or low credit rating in the UK can be quite restrictive in so many ways. You’d discover in your first few weeks that you may have difficulty with basic settlement needs and you can’t access a wide range of financial products or services without a credit history in the UK.

For the finance noob who is unfamiliar with how credit systems work, here’s credit scoring 101.

What is a credit score?

A credit score is a 3-digit number that indicates how reliable you are at borrowing money and repaying debts. It rates your creditworthiness ranging from ‘very poor’ to ‘excellent’. A credit score is the important metric lenders will look at before deciding whether to accept your application for a loan. In some cases, it also helps them determine how much to offer you. Your credit score is determined by a number of criteria, including how quickly you repay borrowed funds if you have any outstanding debt, and whether you have ever missed or made late payments. If you have no credit history, the lenders have no track record to determine your reliability in repaying your debts hence, you are deemed a credit risk.

In essence, with little or no credit to prove you’ve not mismanaged loans in the past, you are unable to access credit or apply for most types of loans.

How are credit scores calculated/determined?

Credit scores are calculated based on credit reports that monitor how an individual has managed their bills and debts in the past. Early bill payment and loan repayment are logged in positively on a person’s credit report, while any late or missed payment will reflect negatively.

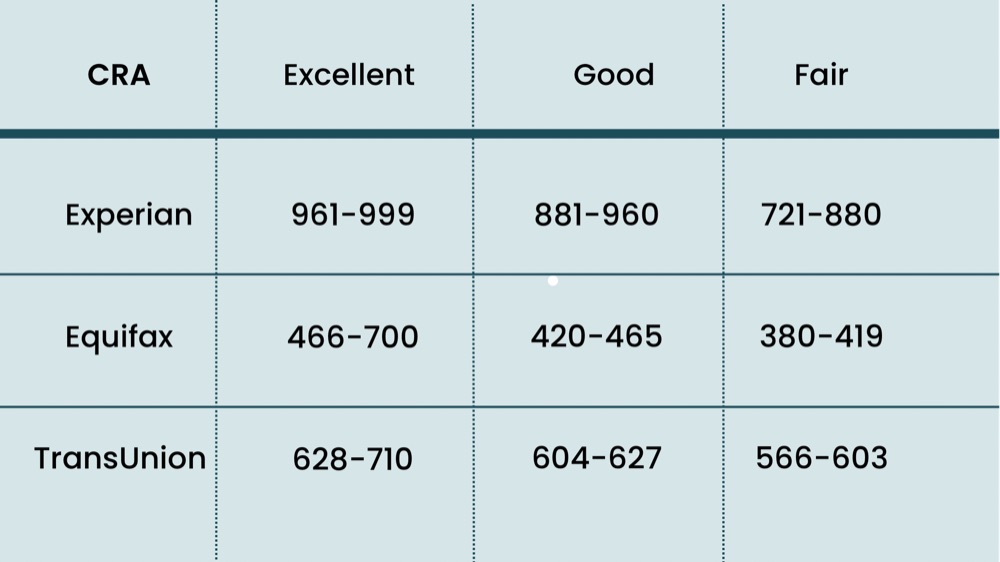

In the UK, there are 3 main credit reference agencies (CRA) that lenders use to assess an individual’s credit application. Each of these agencies uses different scales and scores credit differently.

Here’s an overview:

Despite the fact that these top credit agencies are present in other countries like the US, credit scores are not transferable between countries.

What does your Credit Score affect?

Your credit score affects major parts of your finances. As a new arrival, your lack of credit history can also increase the difficulty of accessing certain financial products such as:

Mobile Contract:

As a newbie, your credit history may be assessed to approve any application for a mobile contract. You might be limited to a pay-as-you-go mobile plan until you are eligible for a mobile contract in a couple of months.

Mortgages:

Getting a property in the UK is hard enough for those with less than two years of UK residency. However, without a good credit score, your application for a mortgage might not even make it past the initial application stage. When you apply for a mortgage in the UK, the lender assesses your bank statements and credit history to determine your ability to manage repayments and predict how you’ll cover the debts in the future. Therefore, without a UK credit history, the lender has no data for reference.

Credit Cards and Loans:

Your credit score will affect your chances of being approved for a credit card and the rates and deals you are offered. Without a good credit history, you might be offered high-interest rates or low credit limits.

Similar to credit cards, your credit score has a huge impact on the chances that you will be approved for a loan.

This brings about a chicken and egg problem since you need to borrow or have a history of loan repayment to be approved for more credit in the first place.

Car and Home Insurance:

There are many factors insurance companies used to determine an individual’s eligibility for insurance coverage and as you can guess, a credit score is one of them.

With a low or limited credit history, you might be deemed too risky to insure. In that case, some insurance companies may offer coverage at significantly higher rates than normal.

Employment:

With your consent, prospective employees are able to assess your credit report when screening you for certain job roles. A history of missed payment might mark you as a high-risk candidate and impact negatively on your application.

Ability to Rent:

Renting a property in the UK is a stringent process that may involve the landlord requesting a guarantor, and checking prospects’ income level and credit history to determine reliable tenants. Unless you have solid proof of income and full employment, renting without a credit history in the UK can be a hassle for a lot of UK newcomers.

Tips on how to build a credit profile

As earlier stated, credit scores do not cross borders. As a result, regardless of how strong your credit is elsewhere, once you’ve moved to the UK, your record is a blank slate and so you have to start building a paper trail as soon as you can.

Fortunately, there are ways to start establishing a credit profile in the UK as soon as you arrive.

Set up your UK Bank Account

Opening a UK bank account boosts your credit by proving you’re a UK resident, you have an ongoing relationship with a bank and that you can manage money well. Staying well above your overdraft limit, paying bills, receiving income and sending money abroad through your UK account will positively impact your credit record.

Register on the Electoral Roll

Getting on the electoral roll once you have a UK address is a quick and easy way to establish a credit footprint in the UK. While signing up on the electoral roll means you are eligible to vote in local elections, it also helps CRAs confirm your identity and personal details to minimise the risk of fraud. However, only citizens of the UK, the Commonwealth, and the EU are eligible to register on the electoral roll.

Get a Credit Card

What better way to show you’re a reliable borrower than demonstrating you can borrow responsibly. While not all credit card companies are open to new arrivals, some will offer you “credit builder” cards which may be high-interest cards. With these cards, the trick is to make minimal purchases, keep within the credit card limit and pay off the full amount every month to create a good credit history.

Take out a Mobile Phone Contract

A mobile phone contract is regarded as a credit agreement and so by making regular payments, you’re demonstrating your ability to repay debts, which is logged positively towards your credit score.

Household bills and Direct Debit

Paying bills on time demonstrates you are financially responsible. A good way to hack this is to set up your bill payment through direct debit or standing order. However, you should always have sufficient money in your account so this doesn’t affect you adversely.

Some of the bills you can set on direct debits include your utility bills, phone bills and insurance.

Find Employment

Get a job or a steady source of income that will be paid into your UK bank account. While having a job in itself doesn’t increase your credit score, it demonstrates a reliable and consistent source of income which will increase your chance of being approved for credit.

While building your credit, here is a list of things to avoid-

- racking up a record of late or missed payments

- making too many credit applications frequently. It’s important to note that every rejection is added to your credit file

- going above your credit limit

- defaulting on credit agreements

- sharing a joint account with someone with a negative credit record

- cash withdrawals with your credit card

- changing your address too often

- errors and incorrect information on your credit file

- bankruptcies, insolvencies and County Court Judgements (CCJs) on your credit history

Conclusion

Creating a credit history in a new country is basically building your financial trustworthiness. It will take a few months to build your credit profile and even years to get a strong credit score required to access major loans and mortgages.

So while on the slow and long journey to ‘limitless possibilities’ of a strong credit rating, it is important not to rack up some bad credit along the way.

You can contact us for more information on how to build your credit profile while you settle in the UK.

Maze provides an end-to-end platform that disrupts the traditional relocation model.

We connect people relocating with service providers, reduce cost and enable the personalization of customer journeys to the UK.

Follow us on Instagram, Twitter, Facebook and LinkedIn, or Contact us with your relocation enquiries.